are union dues tax deductible in 2020

For tax years 2018 through 2025 union dues and all employee expenses are. Learn about the Claim of Right deduction.

A Tax Break For Union Dues Wsj

If youre self-employed you can deduct union dues as a business expense.

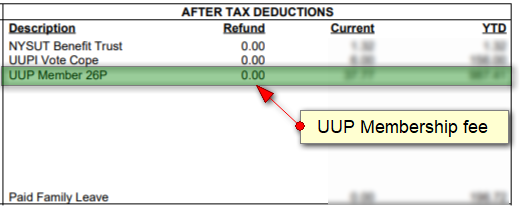

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

. This is in response to an email we received from Craig Mutter on November 23 2020 and our discussion of January 14 2021. If you are an employee you can claim your union dues as a job-related expense if you itemize deductions. Can you write off union dues on your taxes.

Taxpayers who have paid Massachusetts personal income taxes in a prior year on income attributed to them under a. They along with other miscellaneous job-related expenses. I just did a return with Housing Allowance listed there.

UnionMembership fees are tax deductible If you pay work-related union or membership fees you can claim the total cost of these fees. This publication explains that you can no longer claim any miscellaneous itemized deductions unless you fall. The answer to your question is that the deduction for union dues and all employee expenses has been eliminated for tax years 2018 through 2025 regardless of whether an.

Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union. June 3 2019 1127 AM. If you belong to a union or professional organization you can deduct.

For tax years 2018 through 2025 union dues and all employee expenses are. As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union dues from their federal income. You can still claim certain expenses as.

Miscellaneous itemized deductions are those deductions that would have been subject to the 2-of-adjusted-gross-income AGI limitation. A reminder for tax season. SOLVEDby TurboTax8010Updated December 22 2021.

Deduction of union dues. September 16 2020 3 Min Read. Are union dues tax deductible 2020.

Its confusing because in prior years union dues and expenses were deductible on Schedule A. Tax reform changed the rules of union due deductions. Tax reform changed the rules of union due deductions.

Can I deduct my union dues in 2020. Taxpayer is clergy Now Im wondering just hypothetically whether union dues on a clergy return could. Tax reform eliminated the deduction for union dues for tax years 2018-2025.

However most employees can no longer. Employee business expenses are currently not tax-deductible under current federal law as the ability to deduct these expenses has been suspended starting in 2018 and running until 2025. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can.

Tax reform changed the rules of union due deductions. Union Dues or Professional Membership Dues You Cannot Claim. Claim the total of the following amounts that you paid or that were paid for you and reported as income in the year related to your.

Line 21200 was line 212 before tax year 2019.

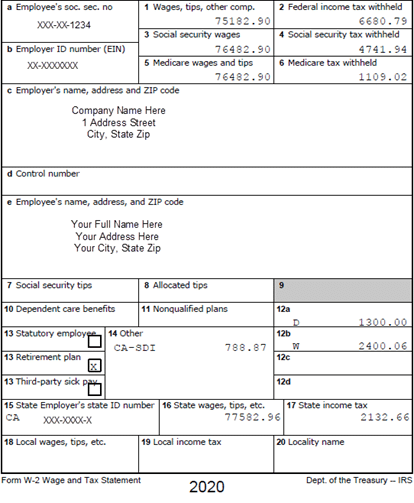

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Understanding Your W2 Innovative Business Solutions

Ny S New Tax Break For A Few Empire Center For Public Policy

Us Department Of Labor Launches New Apprenticeship Finder Tool For Career Seekers Employers Construction Junkie Apprenticeship Department The Unit

A Tax Break For Union Dues Wsj

The Ultimate Tax Deduction Checklist Howstuffworks

Membership Dues Tax Deduction Info Teachers Association Of Long Beach

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Tax Write Offs For Athletes Awm Capital Awm Capital

Which Tax Preparation Program Is Right For You Hawaii State Teachers Association

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

A Tax Break For Union Dues Wsj

Different Types Of Payroll Deductions Gusto

Understanding Your W 2 Controller S Office

A Tax Break For Union Dues Wsj

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition